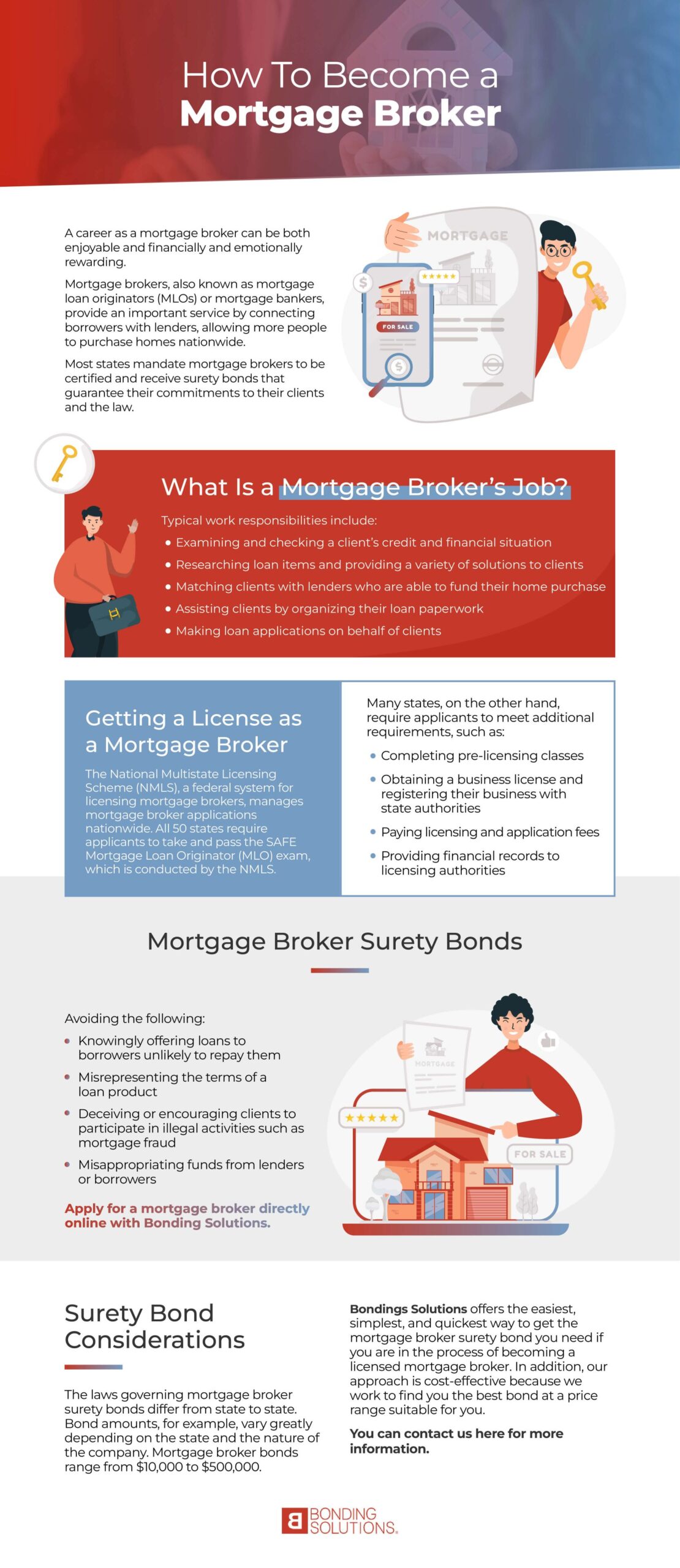

A career as a mortgage broker can be both enjoyable and financially and emotionally rewarding. Mortgage brokers, also known as mortgage loan originators (MLOs) or mortgage bankers, provide an important service by connecting borrowers with lenders, allowing more people to purchase homes nationwide. Those with a passion for math, a knack for solving problems, and a desire to work in finance may find a career as a mortgage broker fulfilling, especially because the field offers strong growth potential.

Mortgage brokers, however, bear a great deal of responsibility for the finances of both their customers and the lenders with whom they operate. As a result, most states mandate mortgage brokers to be certified and receive surety bonds that guarantee their commitments to their clients and the law.

In this article, we discuss mortgage broker responsibilities, how to get a mortgage broker license and the importance of getting a mortgage broker bond.

What Is a Mortgage Broker’s Job?

The majority of mortgage brokers are compensated by the lenders whose loan products they sell, while some are compensated by the borrowers for whom they deal. Mortgage brokers vary from loan officers in that loan officers are employed by individual lenders and only write loans for such lenders. Mortgage brokers look at a variety of lenders’ choices to find the right one for their clients.

Mortgage brokers assist homebuyers in locating mortgages that are both affordable and suitable for their needs. Typical work responsibilities include:

- Examining and checking a client’s credit and financial situation

- Researching loan items and providing a variety of solutions to clients

- Matching clients with lenders who are able to fund their home purchase

- Assisting clients by organizing their loan paperwork

- Making loan applications on behalf of clients

Getting a License as a Mortgage Broker

People who are interested in becoming mortgage brokers can apply for a license in the state where they plan to conduct business. The National Multistate Licensing Scheme (NMLS), a federal system for licensing mortgage brokers, manages mortgage broker applications nationwide. All 50 states require applicants to take and pass the SAFE Mortgage Loan Originator (MLO) exam, which is conducted by the NMLS. The application and exam ensure that every mortgage broker across the nation knows and follows the same guidelines. Purchasing a home is a huge financial commitment and it is important that any mortgage broker you work with will follow all laws and regulations when helping you find the right lender.

After passing the SAFE MLO exam, an applicant has met the most stringent requirement for obtaining a mortgage broker license. Many states, on the other hand, require applicants to meet additional requirements, such as:

- Completing pre-licensing classes

- Obtaining a business license and registering their business with state authorities

- Paying licensing and application fees

- Providing financial records to licensing authorities

Mortgage Broker Surety Bonds

Mortgage broker surety bonds are designed to ensure that mortgage brokers will follow all laws and regulations, avoiding the following:

- Knowingly offering loans to borrowers unlikely to repay them

- Misrepresenting the terms of a loan product

- Deceiving or encouraging clients to participate in illegal activities such as mortgage fraud

- Misappropriating funds from lenders or borrowers

A surety bond for a mortgage broker ensures that the broker will abide by all relevant laws and professional ethics codes. A client, a lender, or a government entity can file a claim against a mortgage broker’s surety bond if they suspect the broker has engaged in any of these activities. The surety will conduct an investigation and, if the claim is true, will pay the claim amount up to the bond’s penalty value, while the broker will be responsible for repaying the surety for the bond claim.

Apply for a mortgage broker directly online with Bonding Solutions.

Surety Bond Considerations

The laws governing mortgage broker surety bonds differ from state to state. Bond amounts, for example, vary greatly depending on the state and the nature of the company. Mortgage broker bonds range from $10,000 to $500,000. Other mortgage professionals, such as bank loan officers, may also be required to obtain surety bonds in some states, which is similar to many other industries as surety bonds protect multiple parties from financial loss.

Anyone who considers applying for a mortgage broker surety bond in the state they plan to conduct business in is responsible for understanding their state’s specific laws. Bonding Solutions is a national surety agency, leading the way in mortgage broker bond production. If you have questions about specific bond requirements for your state, contact our team today!

Bondings Solutions offers the easiest, simplest, and quickest way to get the mortgage broker surety bond you need if you are in the process of becoming a licensed mortgage broker. In addition, our approach is cost-effective because we work to find you the best bond at a price range suitable for you. You can contact us here for more information.