Understanding Surety Bonds

Surety bonds are often crucial for most business owners. Knowing the different types of surety bonds and which ones are required for you to legally run your business is important. Bonding Solutions has been helping business owners get the right bonds at affordable rates for decades. Our team is dedicated to helping you grow your business and one way to ensure that is by obtaining the correct bonds. This article is a simple breakdown explaining exactly what surety bonds are and who needs to carry them and why. If you have more questions about surety bonds, whether it is a court bond, commercial bond, contract bond, or general surety bond, contact our team today!

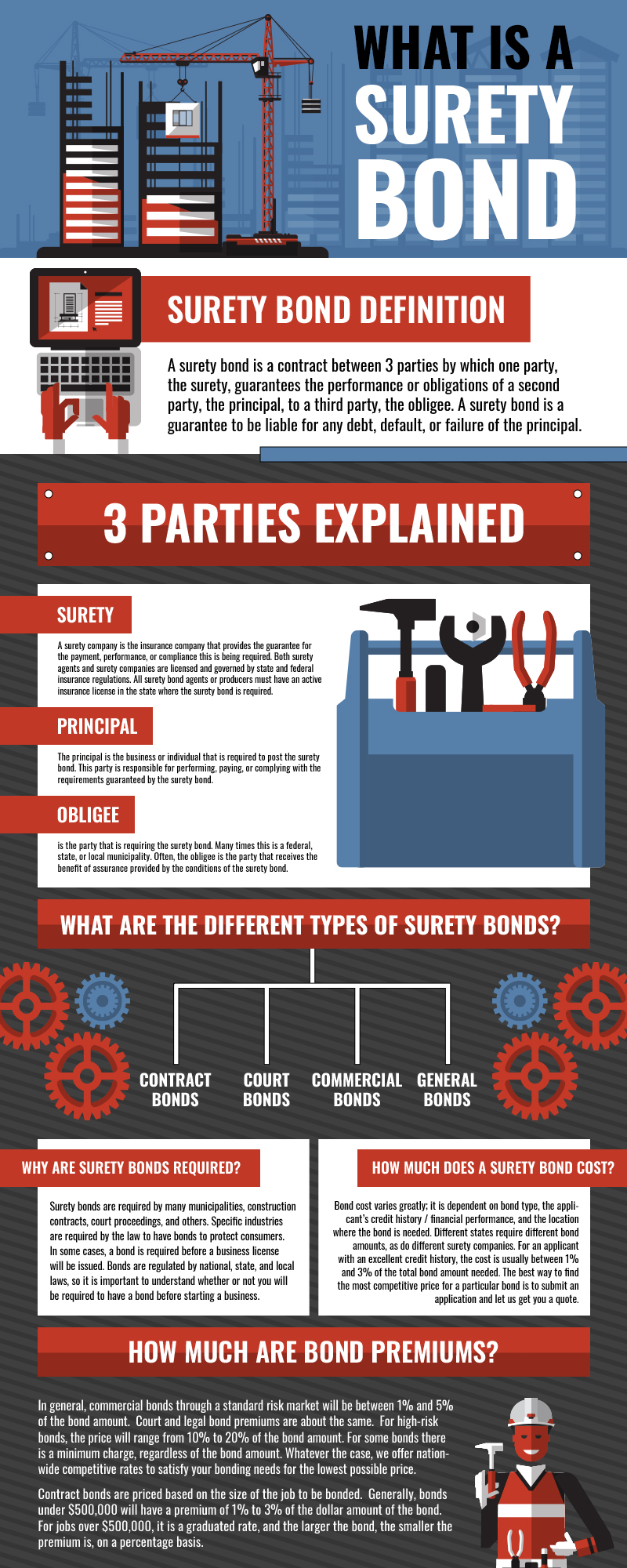

Surety Bond Definition

A surety bond is a contract between 3 parties by which one party, the surety, guarantees the performance or obligations of a second party, the principal, to a third party, the obligee. A surety bond is a guarantee to be liable for any debt, default, or failure of the principal.

3 Parties Involved in A Surety Bond Explained

The Surety

A surety company is the insurance company that provides the guarantee for the payment, performance, or compliance this is being required. Both surety agents and surety companies are licensed and governed by state and federal insurance regulations. All surety bond agents or producers must have an active insurance license in the state where the surety bond is required. Bonding Solutions is licensed to write bonds in all 50 states, making us a national surety agency.

Principal

The principal is the business or individual that is required to post the surety bond. This party is responsible for performing, paying, or complying with the requirements guaranteed by the surety bond. For example, a contractor is often required to obtain a payment bond in order to work on a construction project. The bond ensures that all subcontractors, laborers, and materials will be paid in full, on-time, according to the initial contract.

Obligee

The obligee is the party that is requiring the surety bond. Many times this is a federal, state, or local municipality. Often, the obligee is the party that receives the benefit of assurance provided by the conditions of the surety bond. For a construction project, the obligee would be the project owner or investors, who want the contractor to provide the appropriate bonds to ensure no financial loss on behalf of the contractor’s failure to complete the job according to the specifications of the contract.

Why are surety bonds required?

Surety bonds are required by many municipalities, construction contracts, court proceedings, and others. Specific industries are required by the law to have bonds to protect consumers. In some cases, a bond is required before a business license will be issued. For example, a contractor cannot apply for a contractor license until they obtain a contractor license bond. Bonds are regulated by national, state, and local laws, so it is important to understand whether or not you will be required to have a bond before starting a business. Every state has different bond requirements, if you are unsure of the required bond for your state, you can contact Bonding Solutions today for more information.

How much does a surety bond cost?

The cost of a bond varies greatly; it is dependent on bond type, the applicant’s credit history / financial performance, and the location where the bond is needed. Different states require different bond amounts, as do different surety companies. For an applicant with an excellent credit history, the cost is usually between 1% and 5% of the total bond amount needed. The best way to find the most competitive price for a particular bond is to submit an application and let us get you a quote.

How much are bond premiums?

In general, commercial bonds through a standard risk market will be between 1% and 5% of the bond amount. Court and legal bond premiums are about the same. For high-risk bonds, also know as bonds for bad credit, the price will range from 10% to 20% of the bond amount. For some bonds, there is a minimum charge, regardless of the bond amount, and this will vary based on state and surety agency. Whatever the case, we offer nationwide competitive rates to satisfy your bonding needs for the lowest possible price.

Contract bonds are priced based on the size of the job to be bonded. Generally, bonds under $500,000 will have a premium of 1% to 3% of the dollar amount of the bond. For jobs over $500,000, it is a graduated rate, and the larger the bond, the smaller the premium is, on a percentage basis.

What are the different types of surety bonds?

Contract Bonds

A contract bond, often referred to as a construction bond, includes bid, performance, payment, development, supply, and maintenance bonds for contractors and other companies. A Contract Bond is the guarantee of the performance of a contractor. Contract bonds assure the obligee (the project owner) that the contractor will complete the job at the price it was bid, to the specifications of a construction contract, and that all subcontractors and suppliers will be paid, which is why most contractors must carry a bid bond, a performance bond, and a payment bond for each project. If a contractor fails to complete the contract, a claim can be made against the contract surety bond and the surety company is responsible for compensation to the obligee. The surety company then has the right to take recourse against the contractor for the damages the surety company paid out.

List of Contract Bond Types:

- Bid Bond

- Construction Bond (contract bonds)

- Maintenance Bond

- Off-Site Improvement Bond

- On-Site Improvement Bond

- Payment Bond

- Performance Bond

- Right of Way Bond

- SBA Surety Bond Program

- Site Improvement Bond

- Subdivision Development Bond

- Supply Bond

- Warranty Bond

Court Bonds

There are two main categories that court bonds fall under, judicial and probate. A Court Bond refers to all surety bonds that are required by courts. Judicial bonds may be required when you are dealing with a lawsuit. Simply put, a judicial bond would involve a case that involves the payment of money such as an Appeal Bond, where the money or collateral is held until a decision on the appeal is made. A Probate Bond ensures the honest and faithful performance of a court-ordered duty. An example of this is a Guardianship Bond, in which case a guardian is appointed to a minor and is responsible for making decisions on behalf of the minor. The guardianship bond ensures that the guardian will act lawfully and make decisions that are in the best interest of the minor. Most court bonds are easy to obtain and a national surety agency, such as Bonding Solutions, can help you get the right court bond at an affordable rate, often in less than 24 hours. To learn more about court bonds and the different types of court bonds, click here!

Commercial Bonds

Commercial Bonds are a bond category that includes many different bond types in a variety of different industries. Some examples of commercial bonds include license, permit, business service, fidelity, dealer, and broker bonds. The term Commercial bond acts as an umbrella for thousands of other bond types. Bonding Solutions writes thousands of commercial surety bonds a year and has industry-specific bond programs for many bond types within this category. Most of these bond types are needed by companies or people who are seeking to be licensed in a specific industry. The federal government, states, and other municipalities require licensed professionals to purchase a specific surety bond to stay in compliance with licensing regulations and standards. Common examples of industries that require bonds in this category are auto dealers, contractor licenses, freight brokers, lottery, and mortgage brokers.

Surety Bond Applications

For more information on specific surety bonds, contact Bonding Solutions today. You can also apply online with our simple online application. Our process for writing bonds is customized to cater to each of our client’s needs. We make your business our priority.