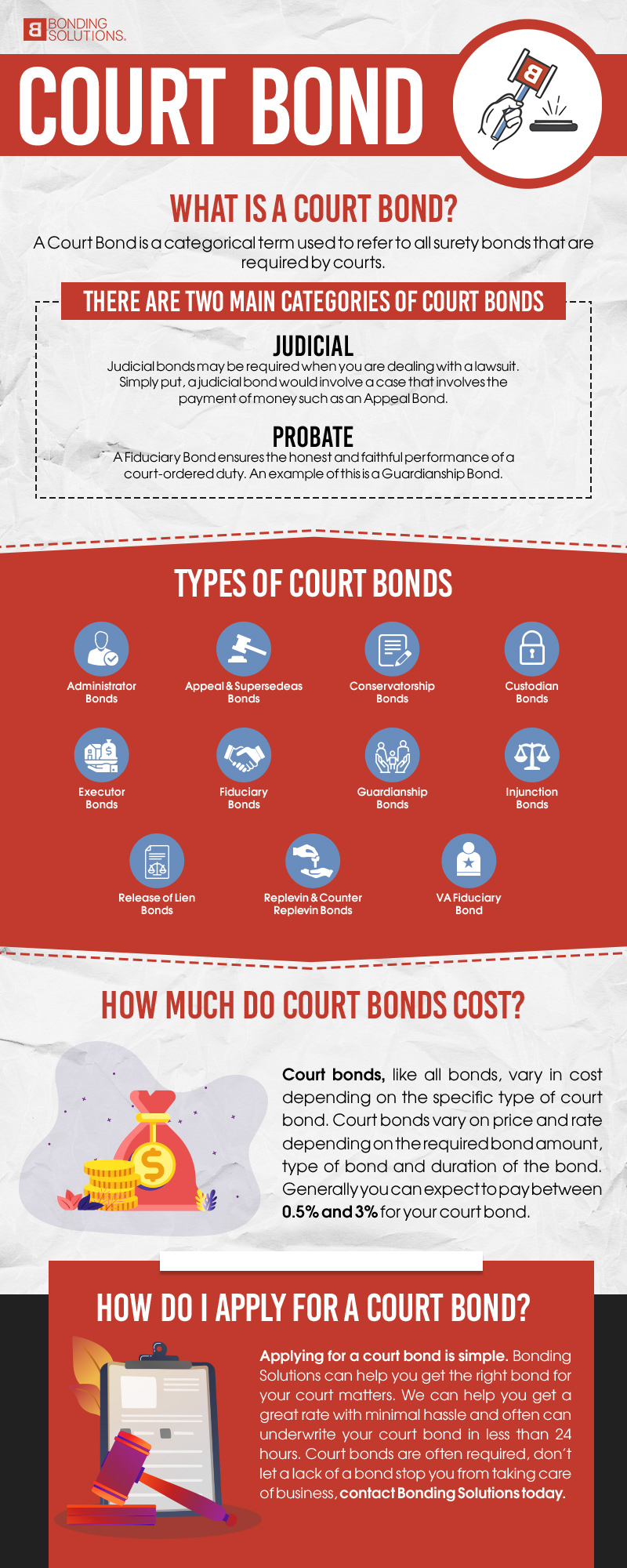

What is a court bond?

A Court Bond is a categorical term used to refer to all surety bonds that are required by courts. There are two main categories of court bonds, judicial and probate.

Judicial bonds may be required when you are dealing with a lawsuit. Simply put, a judicial bond would involve a case that involves the payment of money such as an Appeal Bond. A Probate Bond ensures the honest and faithful performance of a court-ordered duty. An example of this is a Guardianship Bond. Most court bonds are easy to obtain and a national surety agency, such as Bonding Solutions, can help you get the right court bond at an affordable rate, often in less than 24 hours. Listed below are the most common types of court bonds explained.

Types of Court Bonds:

Administrator Bonds

Administrator Bonds are required by the courts when a person dies without a will or without naming an executor for their will. Administrator bonds may also be required if an appointed executor has died, declines to serve as executor or has been removed as the executor. Administrator bonds ensure that the appointed administrator will execute all duties as stated in the will or on behalf of the estate lawfully. This type of surety court bond ensures that no financial loss or improper acts occur on behalf of the administrator.

Appeal & Supersedeas Bonds

Appeal Bonds, also known as Supersedeas Bonds, are required by the court. They allow a party to a lawsuit to appeal a court’s judgment. This type of court bond is often issued in the same amount of the original judgment or sometimes higher, depending on the court order. These bonds almost always require collateral to be posted in advance. Appeal bonds consist of holding the collateral or money until a decision on the appeal occurs.

Conservatorship Bonds

A Conservatorship Bond is a court-ordered surety bond required by probate courts. The court appoints an individual to administer the ward’s estate. Conservators’ responsibilities are often the financial side, rather than being appointed as a guardian. This type of bond is required when a conservatorship is placed for someone who cannot take care of their own financial affairs, therefore someone else is appointed responsibility. This bond protects the person who is unable to handle their own finances from a conservator who mishandles their money in any way.

Custodian Bonds

Custodian Surety Bonds are required of those appointed by the court to administer care to a person who cannot care for themselves. Courts require certain parties to post a Custodian Bond when they have been appointed to care for a person and their personal finances. The bond is often required for custodians who are taking care of minors, the elderly, or a disabled adult. This bond protects the person being cared for from any improper or unlawful acts on behalf of the custodian.

Executor Bonds

An Executor Bond is a type of surety bond that ensures an executor, appointed by the court or by the deceased person before death, is performing their fiduciary duties appropriately. Fiduciary duties include the proper allocation of estate assets to the various beneficiaries and making tax payments for the estate. The executor is also required to split assets according to the will. If the executor fails to complete their duties as stated in the will, a claim can be made against the bond in order to ensure the beneficiaries are compensated accordingly.

Fiduciary Bonds

A Fiduciary Bond, also commonly referred to as a Probate bond, is a court bond required when another person is appointed to act on the behalf of somebody else. A fiduciary is a person who is appointed power over another person’s assets and interests. These bonds are often referred to as Executor and Guardianship Bonds.

Guardianship Bonds

A Guardianship Bond, sometimes referred to as Guardian of a Minor Bond is a bond required by courts to guarantee that an appointed guardian fulfills their duties. Required by the courts, a Guardianship Bond is a surety bond that is used to ensure you fulfill your duties to a minor that you have been appointed a guardian of. This type of surety bond ensures that the guardian will act lawfully and make the best decisions to their ability on behalf of the minor.

Injunction Bonds

An Injunction Bond is a surety bond required by the court that guarantees the protection of the defendant against damages sustained as a result of an injunction by the plaintiff. It provides a guarantee to the defendant that no damages will be sustained should the court dismiss the plaintiff’s lawsuit. This also protects the defendant from an unlawful accusation.

Release of Lien Bonds

A release of lien bond is required to discharge a lien placed against property or project. In order to discharge a lien against the actual property, a Release of Lien Bond is required. The bond is often required for a general contractor who is responsible for paying subcontractors and suppliers.

Replevin & Counter Replevin Bonds

A Replevin and Counter Replevin Bond is required by state laws in various court proceedings. They are used in court cases where the plaintiff claims the property is rightfully theirs and is suing the defendant to regain ownership. The Counter Replevin Bond is a counterclaim to the plaintiff’s Replevin Bond.

VA Fiduciary Bond

A Veterans Affairs Fiduciary Bond is required by the Veteran’s Administration to protect Veterans against the misuse of their finances by those who are court-appointed to act on their behalf. A Veterans Affairs Fiduciary Bond protects against the misuse of funds by any federal fiduciary that is serving as a Veteran’s legal custodian. The legal custodian acts on behalf of the incompetent beneficiary.

How much do court bonds cost?

Court bonds, like all bonds, vary in cost depending on the specific type of court bond required. Court bonds vary in price and rate depending on the required bond amount, type of bond, and duration of the bond. Generally, you can expect to pay between 0.5% and 3% for your court bond. All surety bond rates vary based on the person requesting the bond. Personal finances, such as your credit score and bond history are important factors that are considered when solidifying your premium rate.

How do I apply for a Court Bond?

Applying for a court bond is simple. Bonding Solutions can help you get the right bond for your court matters. We can help you get a great rate with minimal hassle and often can underwrite your court bond in less than 24 hours. Court bonds are often required, don’t let a lack of a bond stop you from taking care of business, contact Bonding Solutions today.