Understanding Commercial Bonds

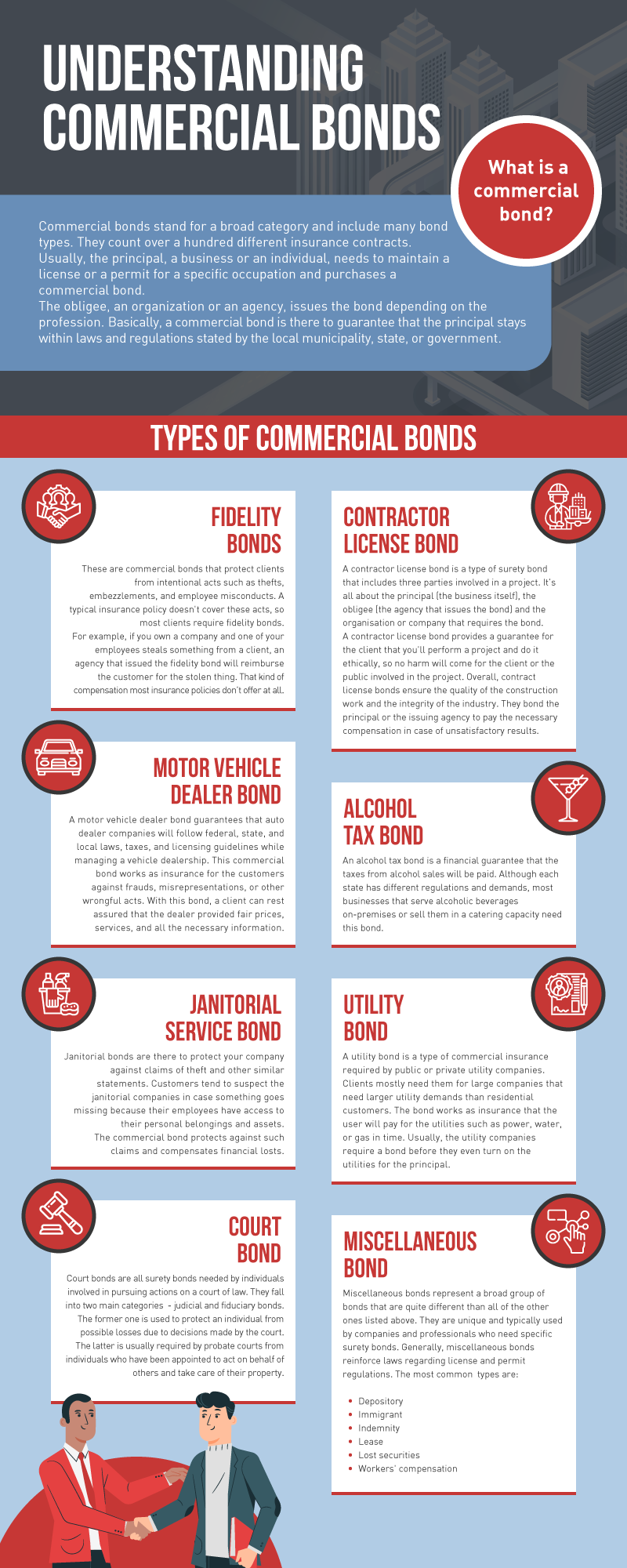

Commercial bonds stand for a broad category and include many bond types. They count over a hundred different insurance contracts. Usually, the principal, a business or an individual, needs to maintain a license or a permit for a specific occupation and purchases a commercial bond. The obligee, an organization or an agency, issues the bond depending on the profession. Basically, a commercial bond is there to guarantee that the principal stays within laws and regulations stated by the local municipality, state, or government.

To help you get the full grasp of this bond type, we provided a guide to understanding commercial bonds. The provided information should answer your questions about what commercial bonds are and how they work, so you can get the proper one for your business. We also list some of the commonly used commercial bonds and briefly explain their meaning and purpose.

What are Commercial Bonds?

The best way to understand the commercial bond is by recalling information about contract bonds because they work in the same way. Surety bonds are agreements that guarantee compliance, payment, or performance of an act. They make unique insurance that certain conditions of the agreement will be followed and fulfilled, mainly regarding construction work but other things as well. If a person or a company fails to fulfill all the parts of the agreement, the company that issued the surety bond takes over to pay off the default.

Following this pattern, commercial bonds guarantee the credibility of the business. If the principal fails to comply with laws for any reason and takes a claim, the obligee acts as an insurer. Therefore, commercial bonds are needed by people or companies who are seeking working licenses for a specific industry. The federal government, states, and other municipalities require licenses that would guarantee the principal’s performance in a certain area.

Different Types of Commercial Bonds

To put things simply, commercial bonds are there to protect clients from potential misdeeds. When you think about it, they might be required for all kinds of businesses. Considering there are a lot of occupations out there, over a hundred commercial bonds might be required for security reasons. Here’s a review of some of the most commonly used types:

Fidelity Bonds

These are commercial bonds that protect clients from intentional acts such as thefts, embezzlements, and employee misconducts. A typical insurance policy doesn’t cover these acts, so most clients require fidelity bonds.

For example, if you own a company and one of your employees steals something from a client, an agency that issued the fidelity bond will reimburse the customer for the stolen thing. That kind of compensation most insurance policies don’t offer at all.

Contractor License Bond

A contractor license bond is a type of surety bond that includes three parties involved in a project. It’s all about the principal (the business itself), the obligee (the agency that issues the bond), and the organization or company that requires the bond.

A contractor license bond provides a guarantee for the client that you’ll perform a project and do it ethically, so no harm will come for the client or the public involved in the project. Overall, contract license bonds ensure the quality of the construction work and the integrity of the industry. They bond the principal or the issuing agency to pay the necessary compensation in case of unsatisfactory results.

Motor Vehicle Dealer Bond

A motor vehicle dealer bond guarantees that auto dealer companies will follow federal, state, and local laws, taxes, and licensing guidelines while managing a vehicle dealership. This commercial bond works as insurance for the customers against frauds, misrepresentations, or other wrongful acts. With this bond, a client can rest assured that the dealer provided fair prices, services, and all the necessary information.

Alcohol Tax Bond

An alcohol tax bond is a financial guarantee that the taxes from alcohol sales will be paid. Although each state has different regulations and demands, most businesses that serve alcoholic beverages on-premises or sell them in a catering capacity need this bond.

Janitorial Service Bond

Janitorial bonds are there to protect your company against claims of theft and other similar statements. Customers tend to suspect the janitorial companies in case something goes missing because their employees have access to their personal belongings and assets. The commercial bond protects against such claims and compensates for financial loss.

Utility Bond

A utility bond is a type of commercial insurance required by public or private utility companies. Clients mostly need them for large companies that need larger utility demands than residential customers. The bond works as insurance that the user will pay for the utilities such as power, water, or gas in time. Usually, the utility companies require a bond before they even turn on the utilities for the principal.

Court Bond

Court bonds are all surety bonds needed by individuals involved in pursuing actions on a court of law. They fall into two main categories – judicial and fiduciary bonds. The former one is used to protect an individual from possible losses due to decisions made by the court. The latter is usually required by probate courts from individuals who have been appointed to act on behalf of others and take care of their property.

Miscellaneous Bond

Miscellaneous bonds represent a broad group of bonds that are quite different than all of the other ones listed above. They are unique and typically used by companies and professionals who need specific surety bonds. Generally, miscellaneous bonds reinforce laws regarding license and permit regulations. The most common types are:

- Depository

- Immigrant

- Indemnity

- Lease

- Lost securities

- Workers’ compensation

- Depository

Other Commercial Bonds

We listed only some of the most common commercial bonds, but there are many others out there you might need for operating your business. Small businesses and individuals also might need to get a commercial bond to ensure their work performance and obtain their working license. Therefore, before concluding you don’t need a surety bond, it’s imperative to double-check the laws and regulations in your state. Of course, you can also get in contact with the surety company and ask professionals for advice.

Why Do I Need a Commercial Bond?

We already mentioned that most businesses need commercial bonds because their customers require them for protection. Cities, countries, or local entities need them for making sure the business will run things legally and provide the necessary performance. However, there are some other reasons why customers might want to get a commercial bond. For example, they cover things that standard insurances don’t, such as thefts and embezzlements. Also, commercial bonds are often an act of good faith. By providing extra insurance for the customer, you guarantee they’ll get what they paid for.

How to Obtain a Commercial Bond?

You shouldn’t have any difficulties with obtaining the commercial bond. It’s only crucial to pick the right company to issue the bond. Not all of them offer the same commercial bonds, and not all bonds meet legal requirements. You want to make sure a company is reliable and that it will provide exactly what you need.

When it comes to the documentation needed for the process, things are pretty simple. Once you pick the agency that will make a commercial bond, you’ll have to provide your financial and business information. Underwriters use this information to evaluate the credit risk and calculate the cost of the bond. Shortly, a company will want to make sure you can pay for the bond or any claims against the bond. However, its interest is to sell a bond to you, so it will provide all the necessary documentation for you to fill in.

Commercial Bonds Cost

Commercial bonds come at different prices depending on the type, state, industry, and application qualifications. Therefore, we can’t say how much each particular bond costs. Some of the main things that will determine the price of the bond are industry experience, credit history, required bond term, and industry risk. Underwriters will take into account all of these things and evaluate the information you provided about your business to determine the price.

Why Choose Bonding Solutions?

Bonding Solutions is a reliable agency you’ll want to pick for creating your commercial bond. With over 60 years of experience, Bonding Solutions offer the expertise and tools needed to compose even the most unique and demanding bonds and satisfy all law and market requirements. Furthermore, you can send a free quote and get all the necessary information about the surety bond you need, including the price.

Understanding Commercial Bonds

In general, commercial bonds are not challenging to obtain. They are just a little bit complicated due to different requirements and law regulations. As we mentioned above, the first and most important step toward obtaining a proper commercial bond is finding a reliable company that will issue the insurance. This way, you can be sure you run your business in compliance with all the local and government regulations.

Hopefully, our guide to understanding commercial bonds gave you a better insight into the topic. Now you know what to expect regarding your own business and make a good decision when choosing a company for making your commercial bond.