How To Renew Your Surety Bond

If you currently have an active surety bond, you might wonder whether and when you need to renew it. Although some surety bonds don’t have a termination date, most of them are valid within a specific period. To make sure you don’t get your project canceled or meet any other repercussions, you’ll need to keep your bond up to date.

We are here to help you make an informed decision and renew your surety bond quickly and effortlessly. Before we dive into all the information about the renewal process, let us review the basics of this contract type. That will give you proper insight into the topic and allow you to renew your surety bond the best way possible.

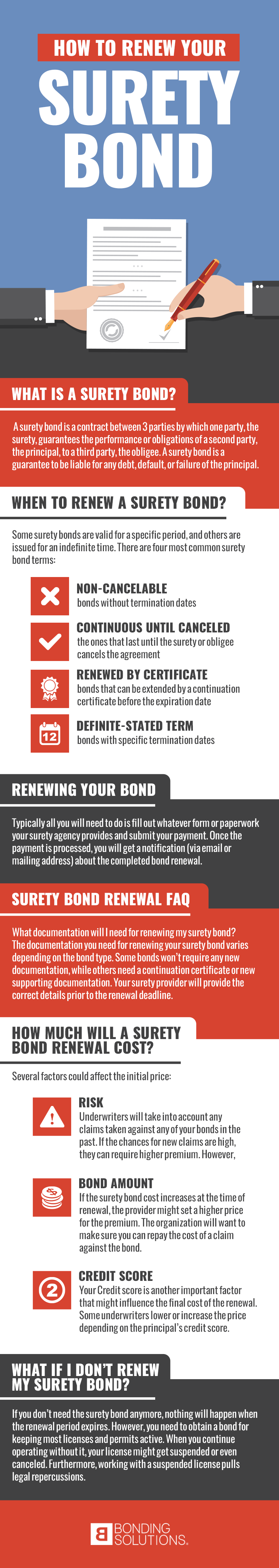

What is a Surety Bond?

A surety bond is a contract between three parties – the contractor, the surety, and the obligee. The contractor is an individual or business that needs to ensure stable work performance to the obligee. Basically, the contractor purchases a bond created by the surety, an organization that takes responsibility for paying the depth in case the principal fails to perform the task. The obligee is typically a government agency requesting a surety bond to avoid financial losses in case the contractor fails to complete a project or meet contract specifications.

The most common surety bonds fall into two broad categories – contract surety bonds and commercial (miscellaneous) surety bonds. The contract bonds mainly guarantee that construction projects will be performed in the future. Commercial bonds, on the other hand, make sure that the contractor obtains a license for occupations, reserves the rights of interested parties in judicial proceedings, and more.

When to Renew a Surety Bond?

As we mentioned above, some surety bonds are valid for a specific period, and others are issued for an indefinite time. If you want to make an informed decision, you should consider the contract term before the purchase. The valid date is typically located in statutes, regulations, ordinances, and optional clause sections of surety bonds.

There are four most common surety bond terms:

- Non-cancelable – bonds without termination dates

- Continuous until canceled – the ones that last until the surety or obligee cancels the agreement

- Renewed by certificate – bonds that can be extended by a continuation certificate before the expiration date

- Definite-stated term – bonds with specific termination dates

Now, there’s one crucial thing to keep in mind with these contract types. A surety bond company can cancel a bond for several reasons, primarily for lawsuits filed against the contract or principal and expired terms. Whatever type of active contract you have, your provider should contact you before the expiry. It’s unlikely that a surety organization will miss sending you an expiration or cancelation notice, but we still recommend caution.

You can avoid the risk of complications and missing the deadline by renewing your bond early. Most surety bonds give a number of days within which the bond remains in effect. The numbers vary depending on the form of each contract but mostly run at 30, 60, and 90 days. If your surety provider doesn’t contact you regarding the renewal, you should contact them ahead of time. The sooner you renew the bond the fewer the risks are of running into any complications.

The Surety Bond Renewal Process

The surety bond renewal process is quite simple and painless. You only need to fill in the form provided by the surety company and submit your payment. Once the payment is processed, you will get the notification (via email or mailing address) about the completed bond renewal.

Here, we have to repeat how important it is to renew your surety bond on time. Invoices take time to process, and surety companies want to collect payments before bonds expire. To make sure you have all the necessary documents signed and delivered on time, we recommend setting up a transfer at least a month before the bond renewal deadline.

Surety Bond Renewal FAQ

Now that we covered the basics about renewing the surety bond, we can focus on some additional aspects of the topic. We answer frequently asked questions to help you resolve all potential doubts you might have about surety bond renewals.

What documentation will I need for renewing my surety bond?

The documentation you need for renewing your surety bond might vary depending on the bond type. Some contracts don’t require any new documentation, while others need a continuation certificate. When it comes to the fixed-term contracts, the surety company might demand an entirely new bond and all the documentation that follows its creation.

Whatever the case might be, the surety bond company will provide you with all the necessary paperwork. We only advise you to ask the provider about potentially new requirements before they send you any documents. By knowing the expectations in advance, you can avoid delays and fill in the paperwork faster.

You can also ask for missing documents. If the obligee changes the renewal requirements, you might find yourself missing the necessary paperwork. In this case, the surety provider should deliver all the lacking materials.

How much will a surety bond renewal cost?

The cost of the bond might change slightly at renewal. Several factors could affect the initial price, and we listed some of them below.

- Risk

Underwriters will take into account any claims taken against any of your bonds in the past. If the chances for new claims are high, they will require a more expensive premium. However, underwriters will also consider years of experience. They will give a lower rate for renewal to those who avoided claims in the past.

- Bond Amount

If the surety bond cost increases at the renewal, the provider might set a higher price for the premium. The organization will want to make sure you can repay the cost of a claim against the bond. In some cases, though, all you need to do is to provide your business and personal financial statements. This way, the surety provider will have a better understanding of your financial situation.

- Credit Score

Your Credit score is another important factor that might influence the final cost of the renewal. Some underwriters lower or increase the price depending on the principal’s credit score.

It’s best to speak with an agent specialized in surety bonds to determine the exact cost of a particular renewal. An agent will work with underwriters to determine the rate of the renewal and find the best option for you. However, if things didn’t change drastically compared to the previous term, the price of the renewal won’t change drastically.

What if I don’t renew my surety bond?

If you don’t need a surety bond anymore, nothing will happen when the renewal period expires. However, you need to obtain a bond for keeping most licenses and permits active. You might even face serious consequences when terminating the bond all on your own.

If you don’t have a surety bond, the obligee concludes you don’t meet the license requirements anymore. When you continue operating without it, your license might get suspended or even canceled. Furthermore, working with a suspended license pulls legal repercussions.

Renew Your Surety Bond with Bonding Solutions

Whether you need to renew your surety bond or apply for a new one, Bonding Solutions is the team to call. We provide affordable rates and fast approval for most bond types. Dedicated team members are ready to help you through the underwriting process from start to finish. Contact our team today!